Day 610 of 1000

Christian sent one of Kelly’s comics to the NCSU student newspaper a couple of days ago, the editor loved it, and put it into today’s paper. She is kicking herself for not having submitted more. We are at the end of the school year, so there is really not much chance to get anything else published this year. She plans to build up a stockpile of comics to submit as soon as the school year begins next year. When we talked about it, she promised to let me publish her work here, too. I have tried to get her to draw consistently and have put stuff on the blog when she produced it, but life is so busy during college, she has not made it a priority. I think all that has changed now and I think it will make this blog more interesting.

I have thought a lot about what I want to do with this blog and how to make it grow lately. Publication of Kelly’s comic strips has been a big part of that. In addition, I talked about the blog a bunch with my buddy Eric from Indiana when he came to visit us a few weeks back with a couple of his kids. We spent a good amount of time talking about blogging and blog monetization. I have given some thought to whether I want to do that with Google AdSense, an Amazon Affiliate program, or some other mechanism. We talked about things I might be able to sell on my blog. Eric showed me several websites on the mechanics of blog monetization. The general consensus from all of them is that content drives blog traffic and sales. Eric also showed me how to determine whether a keyword search on Google was of interest to anyone with the Keyword Tool.

It all sounds pretty interesting and fun. I decided I would try to create content that was both interesting to write (to keep me interested and motivated) and interesting enough to read that more people would come to this blog. Here were a few of my ideas:

- Create more series about how we approach education. Skipping high school and teaching kids to program are the first two. I have some ideas about some more.

- Convince Kelly to provide me with more comic strips.

- Add a weekend series of on-line music videos we like.

- Post a lot more often.

In the final analysis, I think just getting in the habit of writing more often will help a lot. I have given more thought to the blog and posted more the last several months than ever. My readership has taken a fairly dramatic jump, both in quantity and the amount of time spent on the site. I believe dedication to writing and thinking about interesting things to write will do more to improve both the quality of the blog and the readership than anything else. I plan to give this a year or so to improve content and increase readership. I am not sure I will ever monetize the site. The reality is that this kind of writing gives me clarity that I would not have otherwise. I will try to write about where the blog is going every now and then, for my own self as much as for anyone that reads this.

Now that we found out

Now that we found out

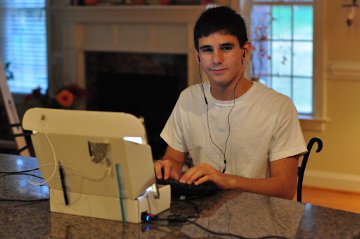

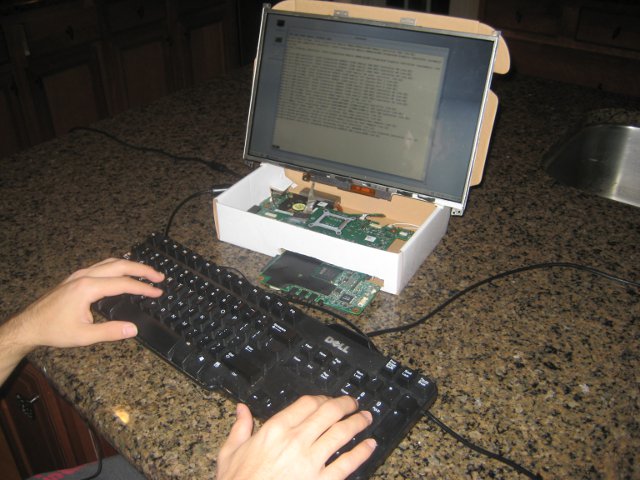

Christian and I put our heads together and decided to buy something a little more robust than the cheapo (but very colorful) Dell girly computers. We got here a factory refurbished Lenovo ThinkPad E520 for $384.01 — a smokin’ hot deal. It will be here before Thanksgiving. Kelly will HATE the color (black), but it is a WAY sturdier computer and has that cool ThinkPad logo embedded in the rubberized top of the computer that gives immediate seriousness cred–much better the foo-fooness cred that derived from her previous pink computer. Christian’s cable should be here any day now. In the meantime, we have to survive the weekend with a need for four computers and only two on hand.

Christian and I put our heads together and decided to buy something a little more robust than the cheapo (but very colorful) Dell girly computers. We got here a factory refurbished Lenovo ThinkPad E520 for $384.01 — a smokin’ hot deal. It will be here before Thanksgiving. Kelly will HATE the color (black), but it is a WAY sturdier computer and has that cool ThinkPad logo embedded in the rubberized top of the computer that gives immediate seriousness cred–much better the foo-fooness cred that derived from her previous pink computer. Christian’s cable should be here any day now. In the meantime, we have to survive the weekend with a need for four computers and only two on hand.