Day 80 of 1000

I found a great article in the Wall Street Journal this morning titled Generation Jobless: Students Pick Easier Majors Despite Less Pay. It had some startling statistics:

Workers who majored in psychology have median earnings that are $38,000 below those of computer engineering majors, according to an analysis of U.S. Census data by Georgetown University.

Wow. The article tells a story about a student who switched from Electrical and Computer Engineering because her team stayed up past midnight in a lab to write a soda machine program. They could not get it to work, so to keep from getting a bad grade, she withdrew from the course. Then she switched from engineering to a double major in psychology and policy management. Her grades went from B’s and C’s to A’s. She said her high school did not prepare her for the rigor of an engineering degree.

So the upshot is that she is willing to work in a low-paying career for the rest of her life because she was unwilling to do what was necessary to pass a few hard classes. I have had this discussion with people before. If you cannot handle a specifc course, you can do a TON of things to make it happen. You can get a tutor. You can take the class two or even three times if needed. You can take a more remedial course, then try the tough one again. Is it worth it to go to school for a year or two more to do something you like and that pays well for the next forty or fifty year? It seems like a no brainer.

The crazy part is that even for those who want to do less technical jobs, it is best to prepare for that non-technical job with a hard degree.

Research has shown that graduating with these majors provides a good foundation not just for so-called STEM jobs, or those in the science, technology, engineering, and math fields, but a whole range of industries where earnings expectations are high. Business, finance and consulting firms, as well as most health-care professions, are keen to hire those who bring quantitative skills and can help them stay competitive.

We joked about this quite a bit, but I wanted to get it into the kids head that, if they went to college (not necessarily a given–preparation for many careers–pilot, electrician, writer, and small business owner are monumentally better served through some type of preparation other than college), they could study their passion, but they needed to start with a rigorous degree. We defined rigorous as anything that involves hard math. The use of hard math and statistics is creating new breakthroughs in a lot of fields right now: medicine, agriculture, sociology, etc., etc. etc.

One of our pet peeves during our homeschool years was a couple of homeschool guys from Oregon who wrote a book titled Do Hard Things when they were in high school, then went off to a liberal arts college whose only majors are Government, Journalism, History, Literature, and Classical Liberal Arts. Those are fine things to study, but are very far from the type of “hard” we are talking about here. The only math I could find in their core curriculum was Euclidean Geometry. If you want to get a book on doing hard things, forego the Harris book and get this one by Katie Davis has done at Azima.

Now that we found out

Now that we found out

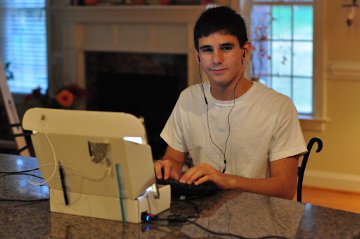

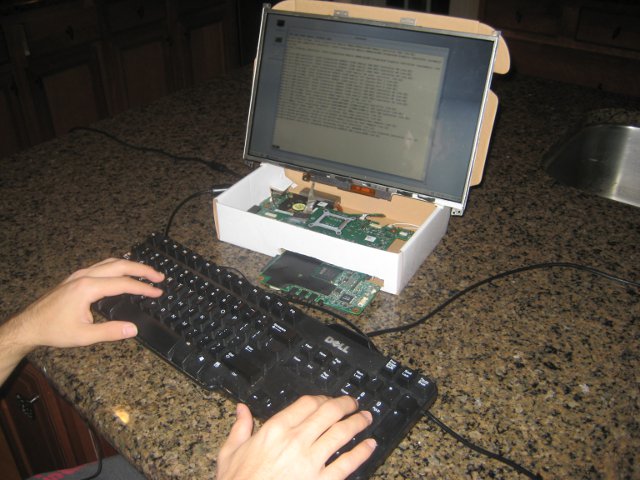

Christian and I put our heads together and decided to buy something a little more robust than the cheapo (but very colorful) Dell girly computers. We got here a factory refurbished Lenovo ThinkPad E520 for $384.01 — a smokin’ hot deal. It will be here before Thanksgiving. Kelly will HATE the color (black), but it is a WAY sturdier computer and has that cool ThinkPad logo embedded in the rubberized top of the computer that gives immediate seriousness cred–much better the foo-fooness cred that derived from her previous pink computer. Christian’s cable should be here any day now. In the meantime, we have to survive the weekend with a need for four computers and only two on hand.

Christian and I put our heads together and decided to buy something a little more robust than the cheapo (but very colorful) Dell girly computers. We got here a factory refurbished Lenovo ThinkPad E520 for $384.01 — a smokin’ hot deal. It will be here before Thanksgiving. Kelly will HATE the color (black), but it is a WAY sturdier computer and has that cool ThinkPad logo embedded in the rubberized top of the computer that gives immediate seriousness cred–much better the foo-fooness cred that derived from her previous pink computer. Christian’s cable should be here any day now. In the meantime, we have to survive the weekend with a need for four computers and only two on hand.