Day 865 of 1000

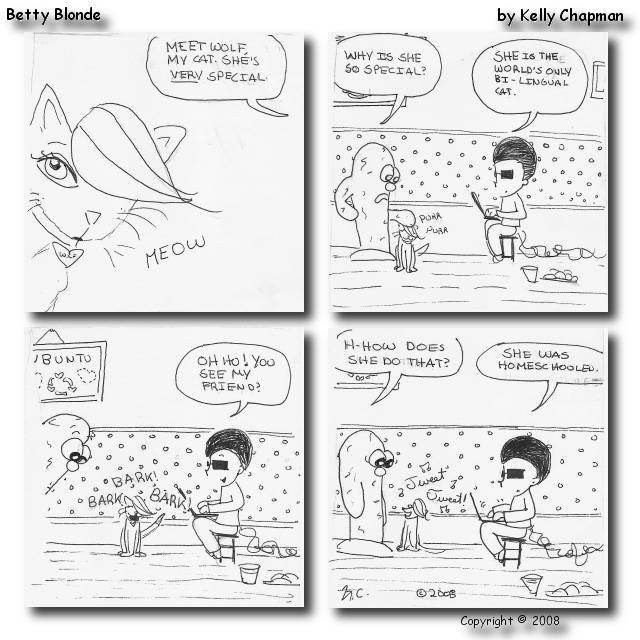

Betty Blonde #31 – 08/28/2008

Click here or on the image to see full size strip.

Carl Bialik, the Numbers Guy over at the Wall Street Journal has an insightful article on a study about fast food workers and how their low wages impact our taxes. Not surprisingly, the liberal authors of the study from Cal Berkeley and U. Illinois, interpret the data to say that low wages workers cost the taxpayers $7 billion dollars per year in benefits from four major nationwide government programs. A professor from my Alma Mater points out the obvious:

Thomas Fullerton, an economist at the University of Texas at El Paso, said his “interpretation of this evidence differs from that of the authors.” Fullerton added, “In the absence of jobs in the food service sector, the fiscal burden represented by these workers would be much worse simply because their income levels would be even lower and they would require greater amounts of public assistance in order for their families to survive.”

A professor from NCSU (Kelly’s and Christian’s school) makes the same point. It is amazing how often academics with an agenda generate some data, then make totally unsupportable conclusions about what the data says. In this case, it seems very unreasonable to conclude that taking away low wages jobs by raising the minimum wage will somehow cost the taxpayers less.